Stamp Duty in Tamil Nadu 2022. By logging in to LiveJournal using a third-party service you accept LiveJournals User agreement.

A Guide To China S Stamp Duty China Briefing News

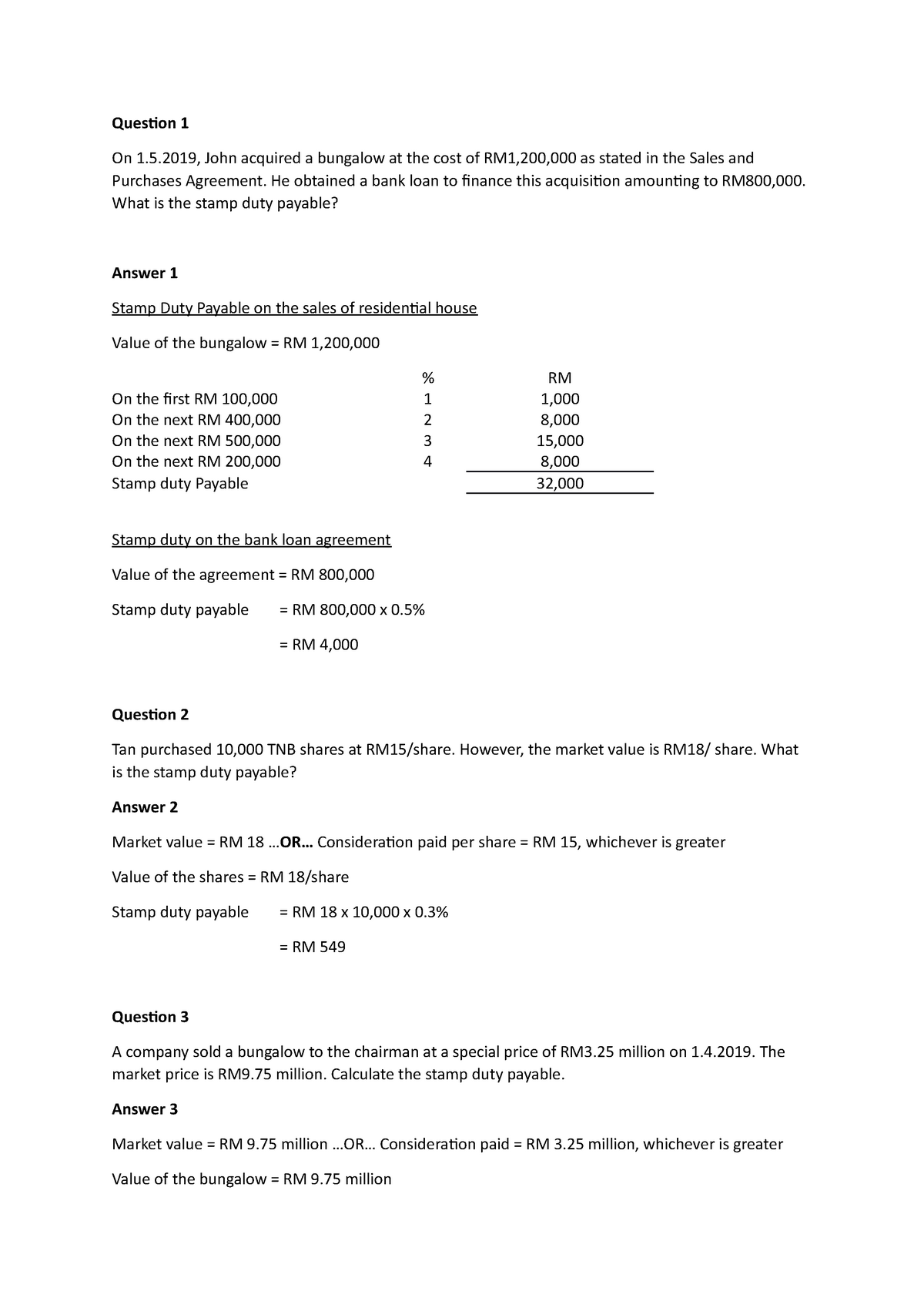

This means that if the buyer has purchased the property for Rs 50 lakhs he has to pay 7 of Rs 50 lakhs as the stamp duty.

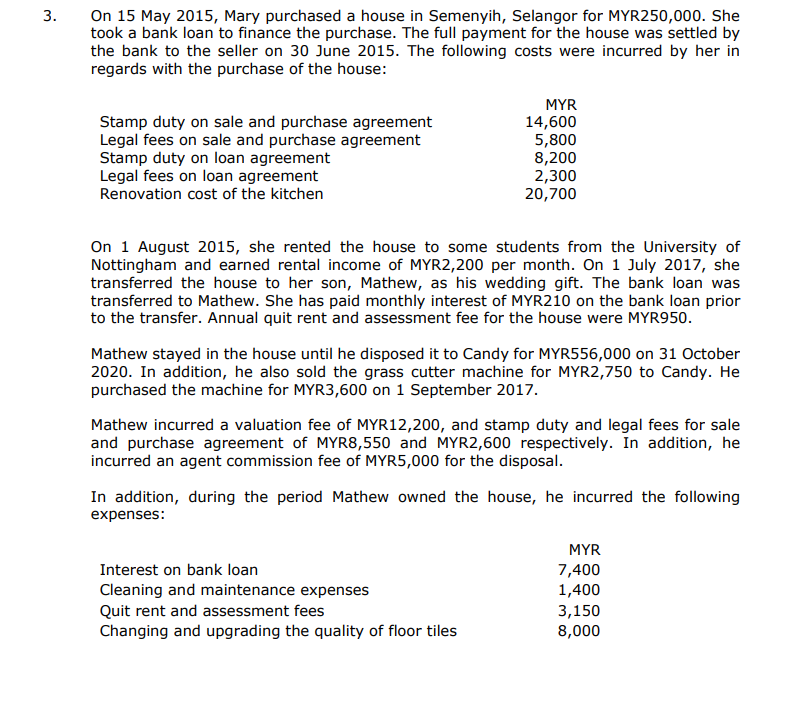

. Stamp duty and registration charges are among the extra charges that need to be paid when you register ownership of your new house. Создание нового журнала. 1 subject to the maximum of Rs200000 Agreement to Sale.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. 1 on the Advance money If possession is given than 1 on total amount. Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it.

Unlike the Buyers Stamp Duty the Additional Buyers Stamp Duty or ABSD is a kind of tax on the purchase of a residential property in Singapore that only affects Singapore Permanent Residents and foreigners or Singapore Citizens who are buying more than one property. 1 on loan amount subject to a maximum of Rs10000 Mortgage with possession. Stamp duty is always shown in percentage terms.

Hi Sreenu Stamp duty will be levied on the total land value of your property. Stamp duty on lease agreements. Federal government websites often end in gov or mil.

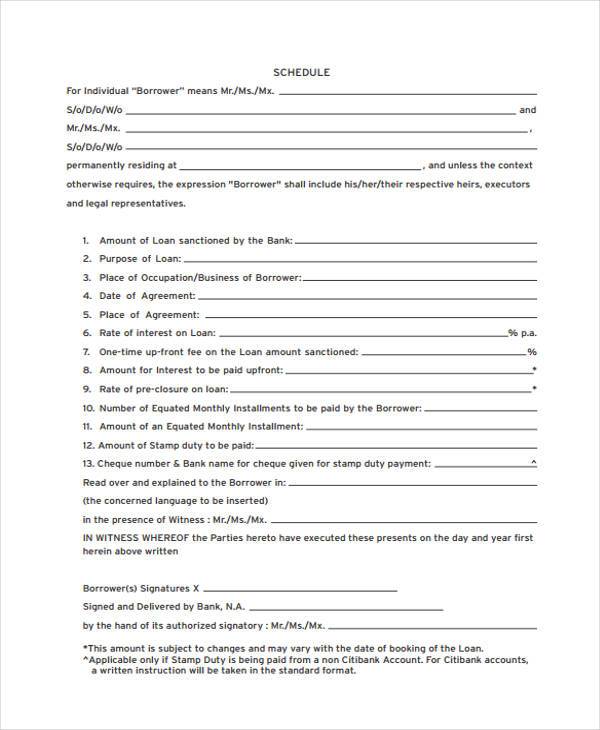

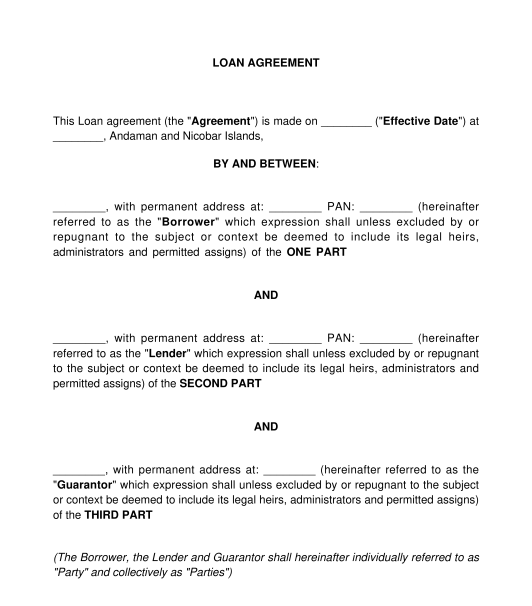

This LOAN AGREEMENT the Agreement is executed and delivered as of April 8 2011 between BrightSource Ivanpah Fundings LLC a Delaware limited liability company Borrower and BDC Ivanpah LLC a Delaware limited liability company Lender such parties to be referenced individually as a Party and collectively as Parties. When do you have to pay stamp duty. How Much Is Stamp Duty For Tenancy Agreement In 20202021.

A plain English guide to Stamp Duty Land Tax SDLT. This means you are borrowing the money to pay stamp duty so youll pay interest on that amount for 30 years. Stamp Duty is payable in full and is to be paid on the deadline.

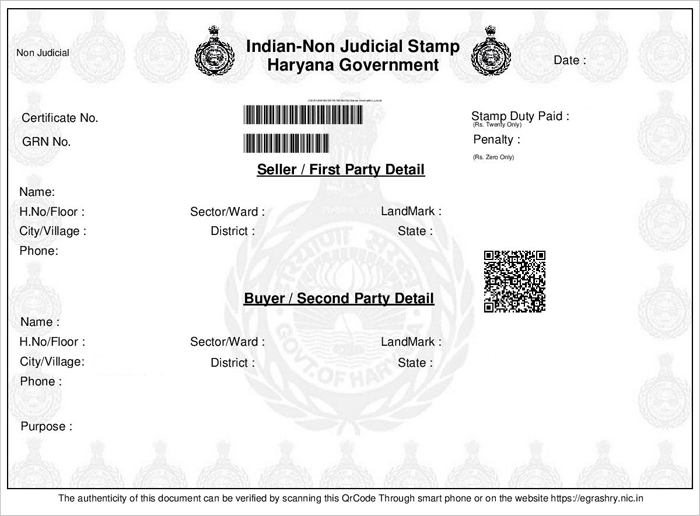

The Registration and Stamp Department has provided various online modes to pay the stamp duty and registration fee through Internet Banking Debit Card Simple Receipts and ESBTR. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. Master Securities Loan Agreement version 1993.

The standard practice is for the tenancy agreement to be stamped and the stamp duty for rental property to be paid before the landlord and the tenant signs the document. The Bajaj Finserv Stamp Duty Calculator is designed to help you accurately assess the amount of stamp duty you will have to pay towards. Master Repurchase Agreement version 1996.

Is a receipt which is printed on normal paper paper size A4 which is a proof of payment made towards stamp duty and registration fee. Calculate now and get free quotation. Sample Draft TemplateLegal Format of Promissory Note in India as per Indian Law.

If youre confused about the rules this is the guide for you. Know about Tamil Nadu Stamp Duty Act registration charges in Tamil Nadu gift deed stamp duty Tamil Nadu and conveyance sale mortgage etc. If it is a resale property extra transfer charges would also be levied.

This is irrespective of the lease term. Stamp duty in Gujarat and registration charges Note. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

First-time homebuyers will get a stamp duty exemption on the instrument of transfer and loan agreement under the Keluarga Malaysia Home Ownership Initiative i-MILIKI says Datuk. Including mortgage deposit stamp duty and solicitors fees. Cost of the property.

Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Lets understand with an example how the stamp duty and registration charges in Madhya Pradesh are calculated. Means the amount given by the Licensee Tenant to the.

The stamp duty charge for rental agreement in Tamil Nadu is usually 1 percent of rent deposit amount. Non-HSBC current account customers could receive the money into a nominated account 3 working days after the signed loan agreement is received. It is a tax paid to the government similar to the income tax.

Promissory Note Loan Agreement for loans to friendsfamily or relatives. If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year 2021 and the past two tax. The stamp duty amount is a specific percentage of the property transaction value.

Buyers will be sent this in an email sometime. Commercial transaction such as if you are purchasing through a company or the transaction is part of a business sale agreement. Home Loans by Banks.

This is known as having your stamp duty capitalised into the principal of the loan. Right now Government charges 5 percent stamp duty on such transactions. Application for Charging Ad Valorem Stamp Duty at Lower Rates Scale 2 13.

131C E Statutory Declaration -. If payment of the stamp duty is delayed it will incur a fine. Rs 5000000 Stamp Duty in MP 750 of propertys cost Rs 375000.

4 on loan amount. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. Before sharing sensitive information make sure youre on a federal government site.

See License Agreement for details. In most cases properties in rural areas usually attract subsidised stamp duty rates as compared to urban areas. Means Months Years not exceeding 60 months 5 years for letting of an immovable property such as Residential Office Shop and Industrial on Leave and Licence basics ua 36A of Maharashtra Stamp Act.

You cannot use your mortgage loan to pay the stamp duty but if you have a large deposit you. If you buy a house youll have to pay Rs 525 lakh in stamp duty and registration charges on a property worth Rs 5000000. Stamp duties are payable pursuant to Section 3 of the Indian Stamp Act 1899.

The gov means its official. When taking a home loan there are a host of expenses involved beyond the cost of the house itself. The reduced stamp duty shall apply to all loan agreements executed by such borrowers in favour of banks financial institutions and financial development corporations among others.

Make overpayments free of charge. Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250. Stamp duty varies depending on the tenure of the loan as also the quantum and type of the loan.

1 on the loan amount that is subjected to a maximum of Rs 40000. As per a report in July 2020 the Tamil Nadu Government is likely to reduce stamp duty and registration charges for all rental agreements of more than 12 months. One may also have to verify the ownership of the asset that is given asw collateral.

This is however a grey area and usually no penalty will be levied if the stamp duty is paid within 14 days of the tenancy agreement being signed in Singapore and 30 days if. Informative Guide Line for Leave and Licences Agreement.

What Is Stamp Duty In India How To Pay Stamp Duty Online

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

Stamp Duty For Bank Loan Agreement In Details Youtube

Sunnybank Apartment Jade Purchased An Apartment In Chegg Com

Homesaya 𝐒𝐭𝐚𝐦𝐩 𝐝𝐮𝐭𝐲 𝐜𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐋𝐨𝐚𝐧 𝐀𝐠𝐫𝐞𝐞𝐦𝐞𝐧𝐭 𝐚𝐧𝐝 Facebook

Tutorial Stamp Duty Quesion 1 On 1 5 John Acquired A Bungalow At The Cost Of Rm1 200 000 As Studocu

Non Judicial Stamp Papers And Its Value Law Insider India

Legaldesk Com Stamp Duty Payment Api

Stamp Duty In Malaysia Everything You Need To Know

Is Backdate Rent Agreement Created On Today S Date Stamp Paper Allowed Quora

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Twitter 上的 Manvendra Singh How Customer Can Sign Blank Stamp Paper Rbi Aajtak Finminindia Nsitharaman Ndtv Ani Zeebusiness Dchaurasia2312 Please Suggest I Need To Stop Emi Or I Need To Sign Blank

3 On 15 May 2015 Mary Purchased A House In Chegg Com

Stamp Duty On Loan Agreements And Security Documents Prabal Goel Youtube

What Is Stamp Paper Stamp Duty

Loan Agreement Template Online Sample Word And Pdf

Things To Keep In Mind When Lending Money Businesstoday Issue Date Jan 31 2013

Budget 2020 Stamp Duty On Foreign Currency Loan Agreement To Be Increased Raja Darryl Loh